January Effect 2017 E-mini S&P Video

At the end of every January, day traders use a special technique to gauge how market activity may play out for the rest of the year. We’re talking about the January Effect. Let’s say on January 2, 2017, the E-mini S&P’s closed for the day at 2200. Let’s say that on January 31, 2017, price closed at 2230. For the month of Janmuary, price closed higher than it opened. According to the rules of the January Effect and its historical accuracy, a higher close than open means that the market may also trend upward (overall) for the rest of the year. In December, the market should close higher than the January price.

Of course, expect price to fall on a regular basis. However, John Paul believes you can catch the upward retracements by following his examples in this video.

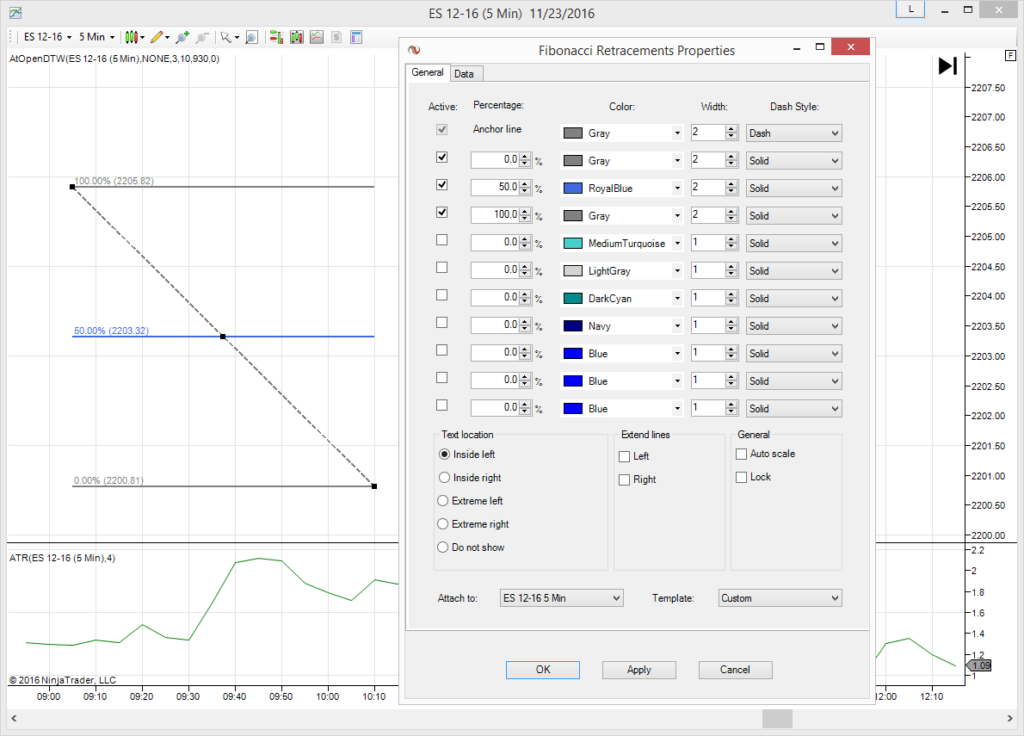

Take a look at the video above. John Paul uses NinjaTrader’s Fibonacci Retracement tool (F8) configured to show 0%, 50%, and 100% levels. If you’re using NinjaTrader, you can configure your Fibonacci tool to look the same way. On the chart, using the drawing tools menu to click the Fibonacci Retracement tool or simply press F8. Click and drag to make the tool appear. Remember, you can customize the placement later.

Adjusting the Fibonacci Tool for the January Effect

Now, adjust the settings by double-clicking the tool. In the left column of values, use 0%, 50%, and 100%. Set the remaining values in the column to zero and uncheck them. For each visible line, set the width to two. I prefer to set the 0% and 100% lines to the same color, gray, and the 50% line to royal blue. The 50% line is important because that’s the trigger for the entry. Cick OK and the changes will apply. The settings will not be saved, but you can copy and paste each tool in case you need more than one on your chart. Simply click on the tool so the black handle squares appear, use Ctrl+C or right-click > copy, then paste wherever desired.

Watch this video a couple times until you can comfortably find breakout points. If 2017 does indeed close higher, then you will be able to easily identify multiple opportunities. You can learn more about different trading strategies at DayTradeToWin.com.