Sonic: Master Price Action Trading

Today, we’re back at it with the powerful Sonic Trading System. Before we dive in, just a quick reminder: trading carries risk, so always use money you can afford to lose. If you’re part of Day Trade to Win, don’t…

Today, we’re back at it with the powerful Sonic Trading System. Before we dive in, just a quick reminder: trading carries risk, so always use money you can afford to lose. If you’re part of Day Trade to Win, don’t…

Thinking about selling the market? Timing your entry makes all the difference between a winning trade and getting caught in a reversal. Today, I’ll show you how to short the smart way using the Trade Scalper and Roadmap tools from…

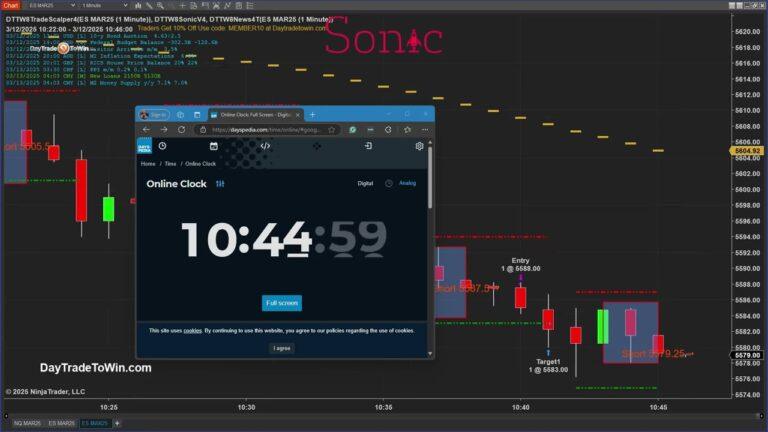

Just wrapped up a trade I couldn’t wait to share—executed live using the Sonic System on the Micro E-Mini S&P (MES). This quick setup shows exactly how effective price action trading can be when you know what to look for.…

Today, I’m excited to walk you through some market opportunities using the Sonic price action system. Whether you’re trading futures, crypto, or even stocks, the Sonic system is incredibly versatile and adaptable to almost any market condition or asset type.…

Happy Monday traders! The markets opened strong — and by strong, we mean a clear, steady downtrend. Perfect conditions for the Sonic Trading System by Day Trade to Win, which has been firing off short trade signals all morning on…

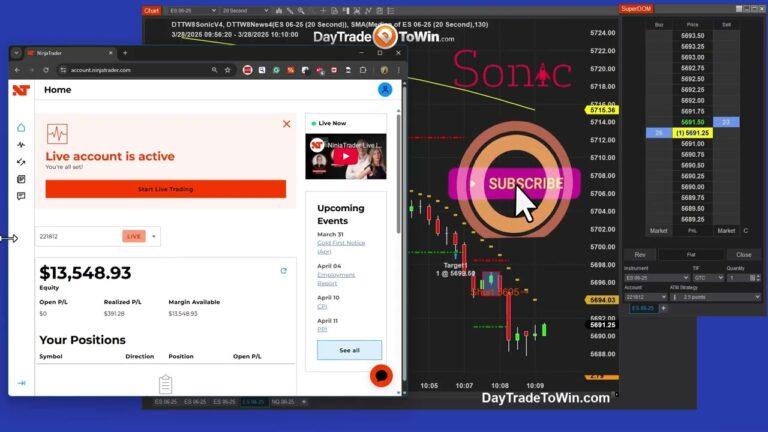

Hello Traders! Today, I’m excited to share my live trading experience using the Sonic System. Whether you’re trading with a $1,000 account or managing larger funds, these insights will help you make smarter decisions and improve your trading strategy. Step…

Navigating the financial markets requires precision, strategy, and the right tools. DayTradeToWin’s Sonic System and RoadMap provide traders with clear signals and market insights to enhance decision-making. In this guide, we’ll explore how to apply these tools effectively in live…

Today, we’re analyzing the market using the Sonic Trading System and Trade Scalper, identifying potential trading opportunities. Remember, trading carries risk—only trade with funds you can afford to lose. Market Overview & Trade Setup The Sonic Trading System has generated…

March has brought a persistent market downturn, but with every challenge comes opportunity. While prices continue to fall, savvy traders can capitalize on both the downtrend and the potential for an upcoming reversal. Profiting from the Downtrend The Sonic System…

Welcome to today’s market recap! It’s Wednesday, March 5th, and the Sonic Trading System has once again demonstrated its power in identifying high-probability trades. If you’re looking for a consistent way to navigate the markets, this system is a game-changer.…