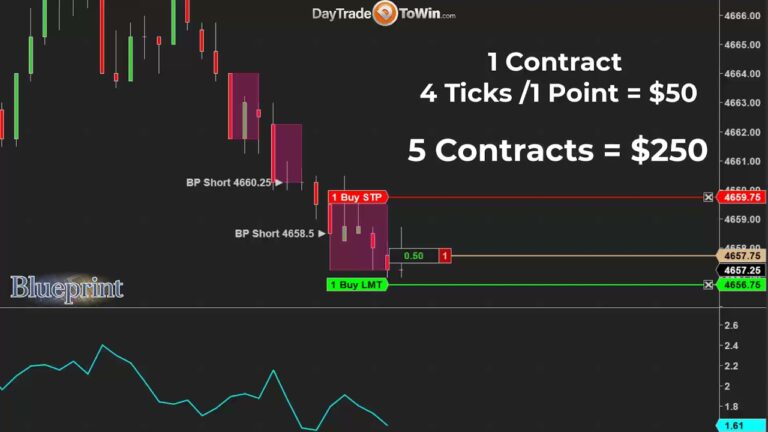

New Blueprint Method From DayTradeToWin

John Paul of DayTradeToWin has been fond of the 5-Minute and 1-Minute chart types for a number of years. When the 5-Minute chart is too volatile, he often recommends using a 1-Minute chart, as this causes the profit target and…