Price Action Trading & Trade Confidently

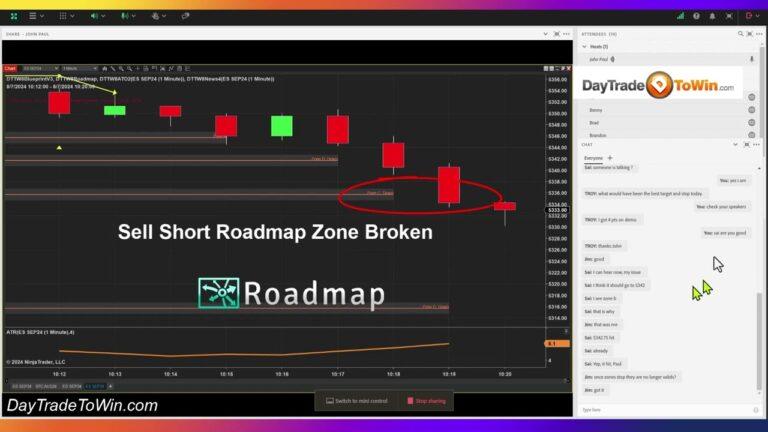

Are you tired of lagging indicators and complicated trading systems? At daytradetowin.com, we focus on price action—a straightforward, effective approach to trading that helps you make decisions based on real market movement, not outdated signals. Why Price Action? Price action…