Beat Market Manipulation

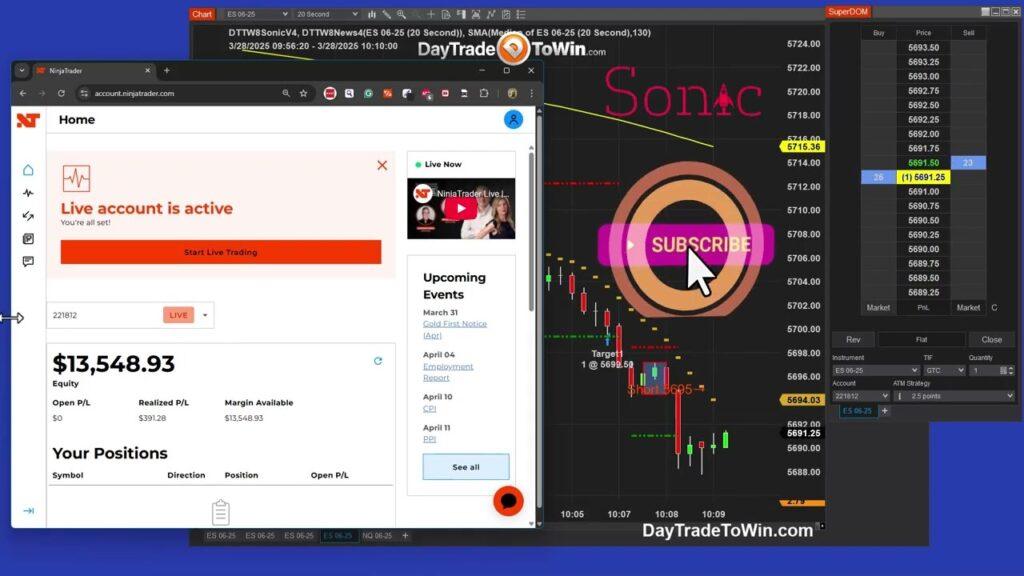

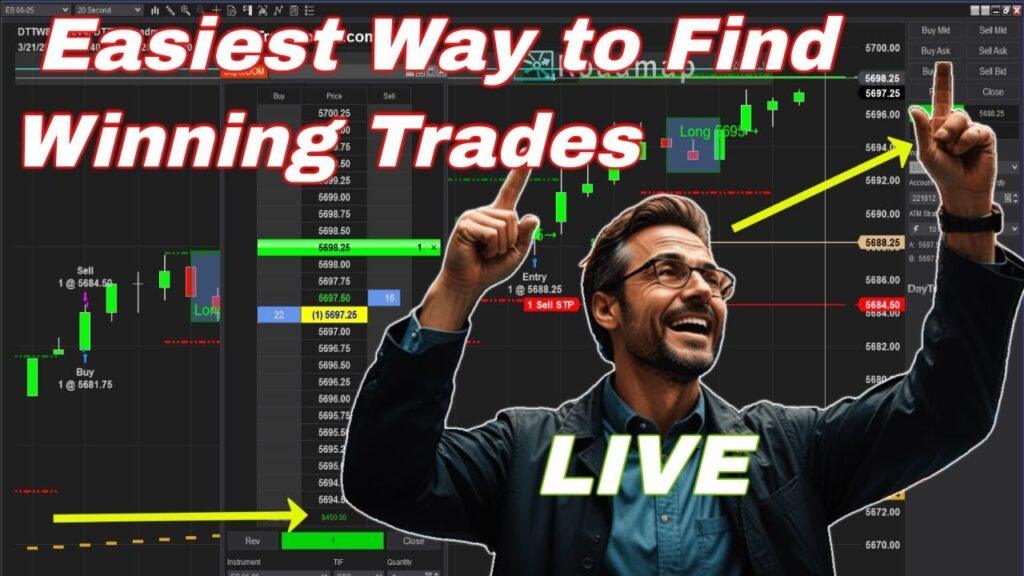

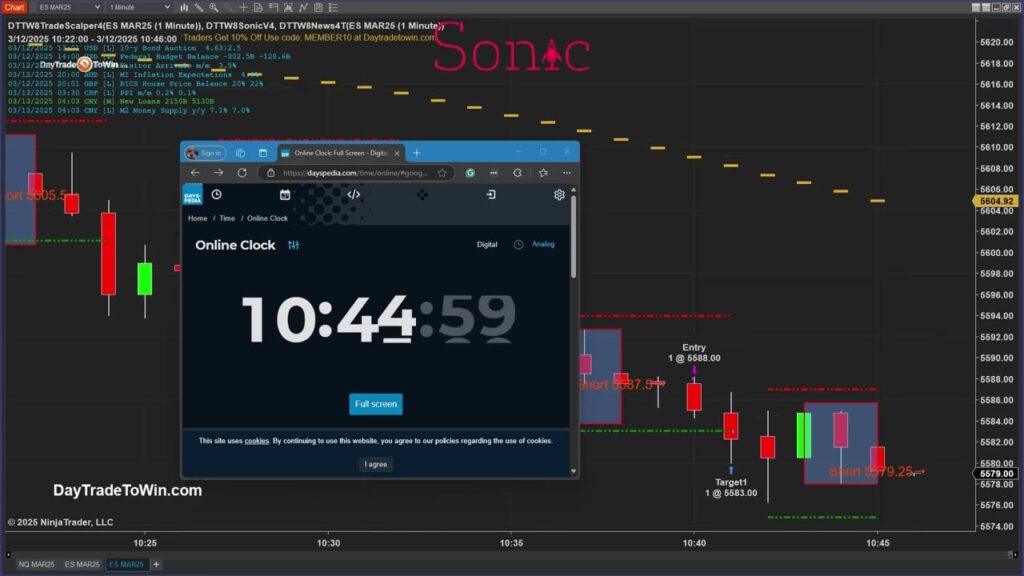

Thinking about selling the market? Timing your entry makes all the difference between a winning trade and getting caught in a reversal. Today, I’ll show you how to short the smart way using the Trade Scalper and Roadmap tools from DayTradeToWin. Don’t Just Sell — Follow the Market to the…