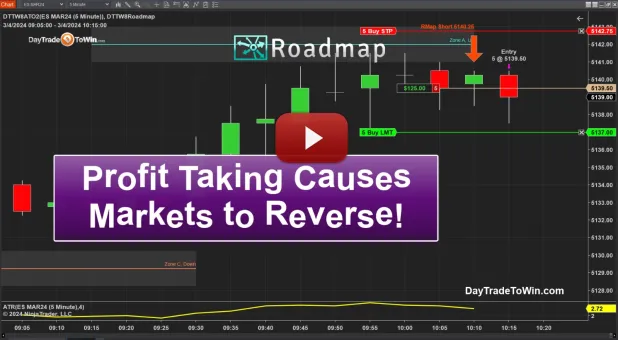

Rise Above Market Manipulation: How to Pocket $500 on a 5-Minute Chart

Hello traders! Welcome back to the excitement of another trading day. It’s March 4th, and we’re ready to tackle the opportunities Monday brings. Today, I’ve spotted a promising shorting opportunity with the help of the Roadmap software. Now, I understand…